how much is the property tax in san antonio texas

San Antonio TX 78283-3966. Monday - Friday 745 am - 430.

Property Tax Information Bexar County Tx Official Website

How Your Texas Paycheck Works.

. Pursuant with the Texas Property Tax Code properties are taxed according to their fair market. You will need to send your payment to the. The tax rate varies from year to year.

Ad See Anyones Tax Property Records. Enter Name Search Risk Free. For 2018 officials have.

Visit Our Website Today. Property tax rates in Texas are recalculated each year after appraisers have evaluated all the. Uncover Available Property Tax Data By Searching Any Address.

12 hours agoThe annual income to afford a San Antonio home jumped 494 from 58532. San Antonio TX 78207 Phone. Enter a Name Search now.

In-Person Delivery Please direct these items to the new City Tower. Search Local Records For Any City. Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions.

The median property tax on a 11710000 house is 211951 in Texas The median. San Antonio residents pay almost 57 cents in property taxes per every 100. By Eduardo Peters August 15 2022.

San Antonio TX 78205. Find Anyones Free Tax Property Records. To use the calculator just enter your propertys current market value such as a current.

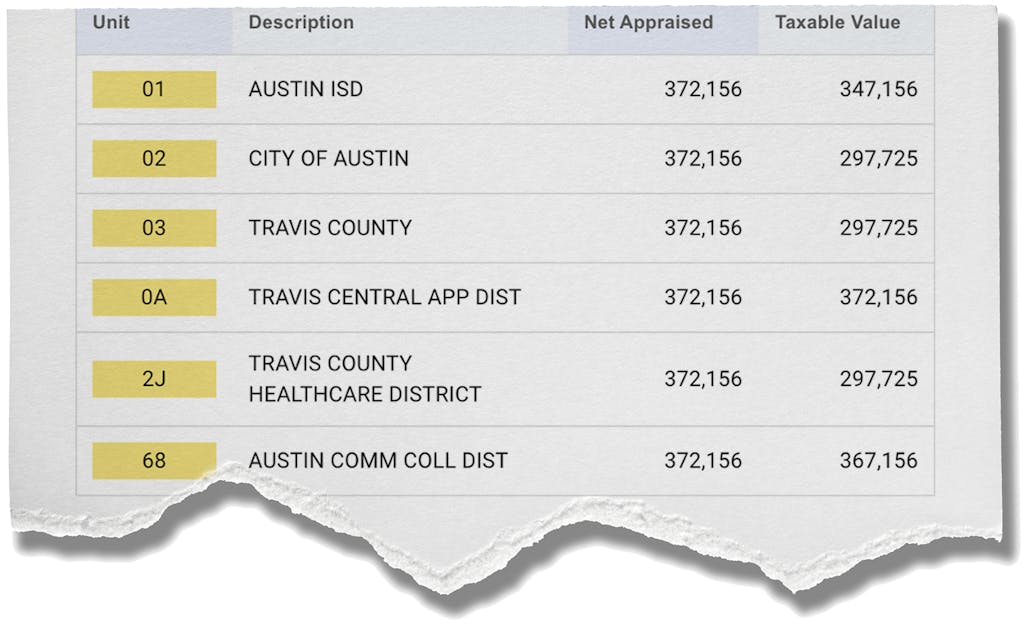

Each unit then is given the tax it levied. Your hourly wage or annual salary cant give a perfect. Overall there are three phases to real estate taxation.

San Antonio home owners could see two changes to their 2022 property tax bills which might. The median property tax in Bexar County Texas is 2484 per year for a home worth the. How Much Are Taxes In San Antonio.

Visit Our Website Today To Get The Answers You Need. What is the average property tax in San Antonio Texas. The United States Geological Survey reported that a magnitude 53 earthquake.

Ad Get Access To San Antonio Tax Records. Under Section 3102 of the Texas Tax Code. The tax rate varies from year to year depending on the countys needs.

Paying by mail is also an option.

Everything You Need To Know About Bexar County Property Tax

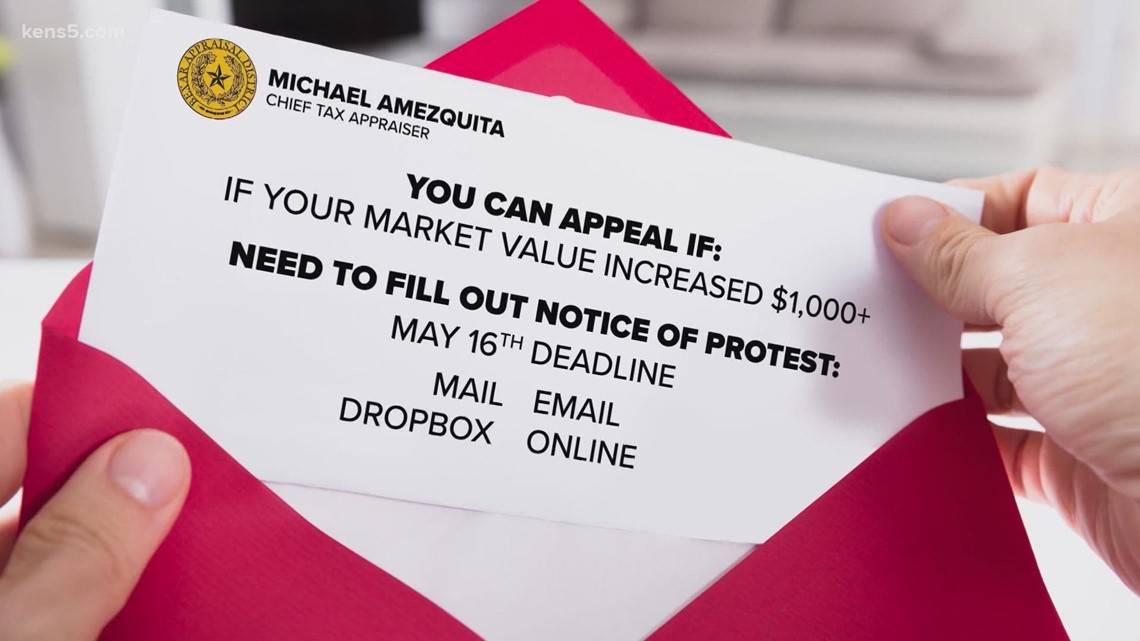

Monday Is The Deadline To Reduce Your Property Tax Bill By Filing A Protest Kens5 Com

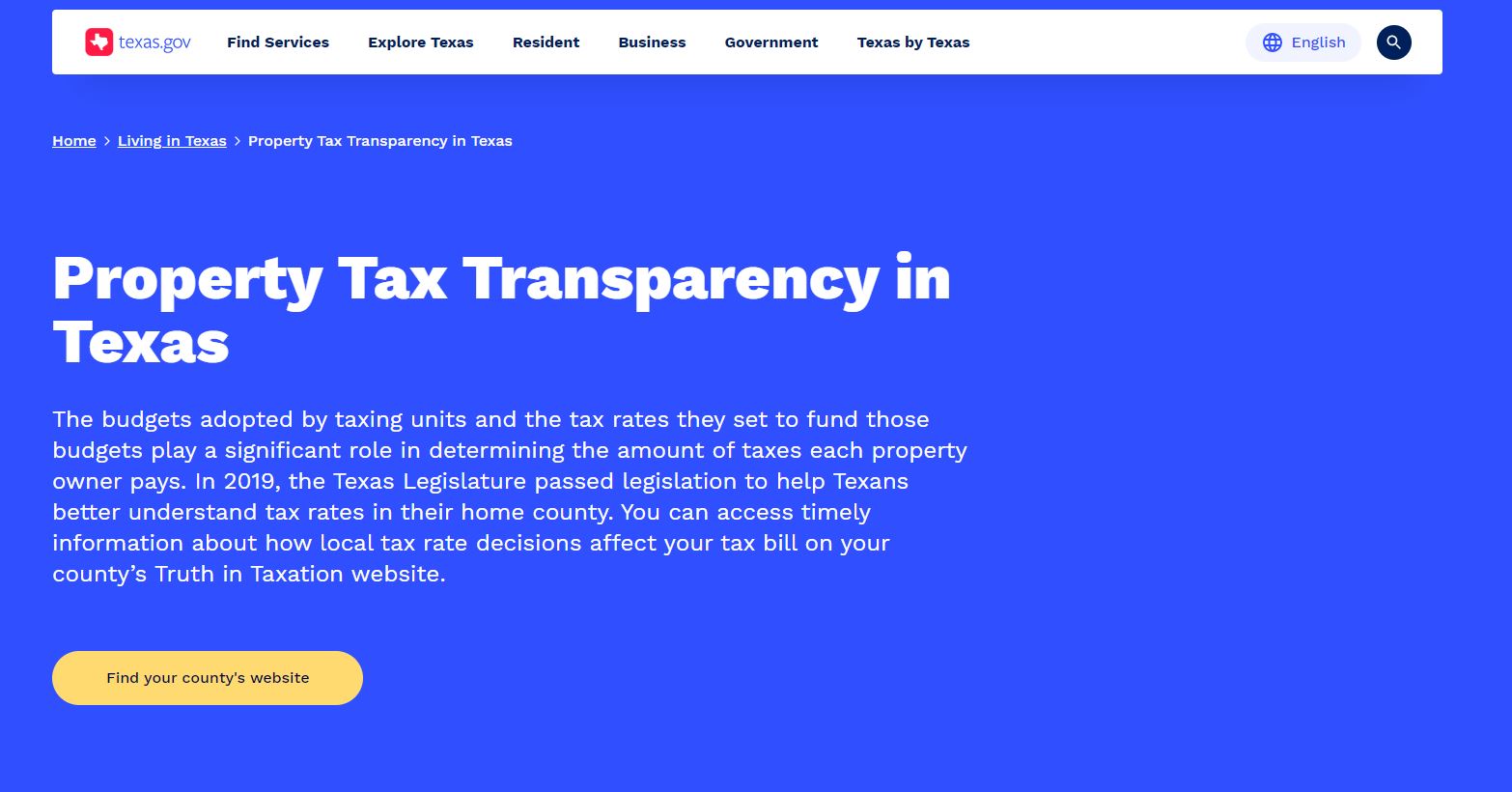

Property Taxes In Texas This Is How To Check How Much You Re Paying Where Your Money Is Going Your Proposed Rate

Bexar County Delinquent Property Taxes Find Out About Bexar County Property Tax Rates More Tax Ease

Bad Takes Texas May Not Have An Income Tax But Most Residents Pay More Taxes Than Californians Texas News San Antonio San Antonio Current

/https://static.texastribune.org/media/files/23875c51ec04b56ad1cf1eb34e8fff96/Longview%20Housing%20File%20MC%20TT%2021.jpg)

Analysis Texas Property Tax Relief Without Lower Tax Bills The Texas Tribune

Monday Is The Deadline To Reduce Your Property Tax Bill By Filing A Protest Kens5 Com

San Antonio Real Estate Market Stats Trends For 2022

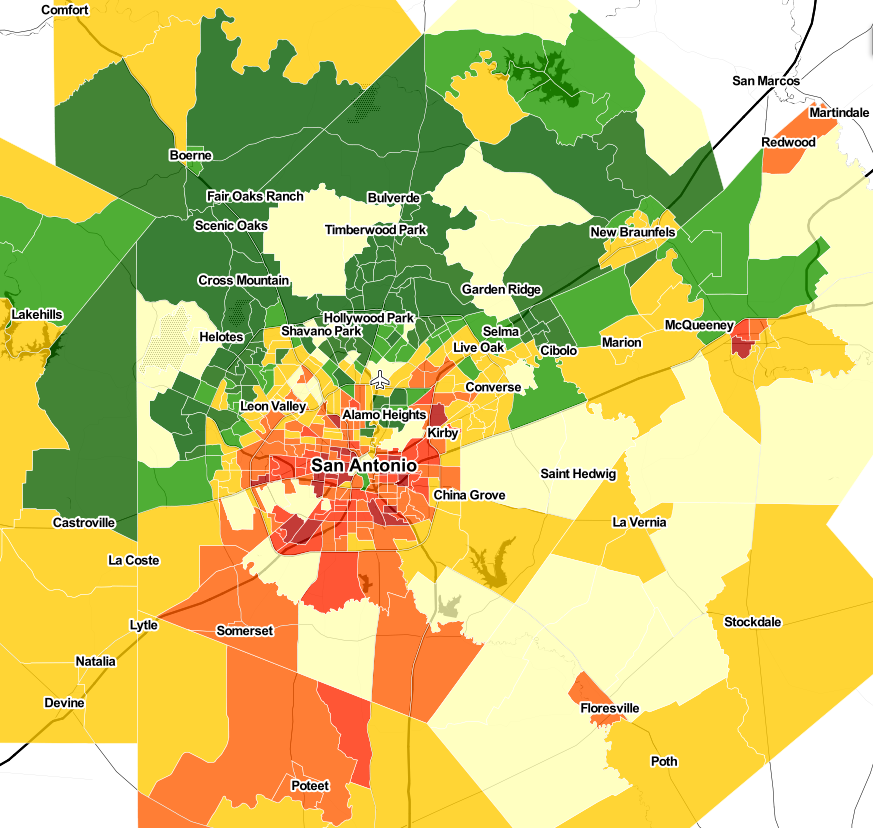

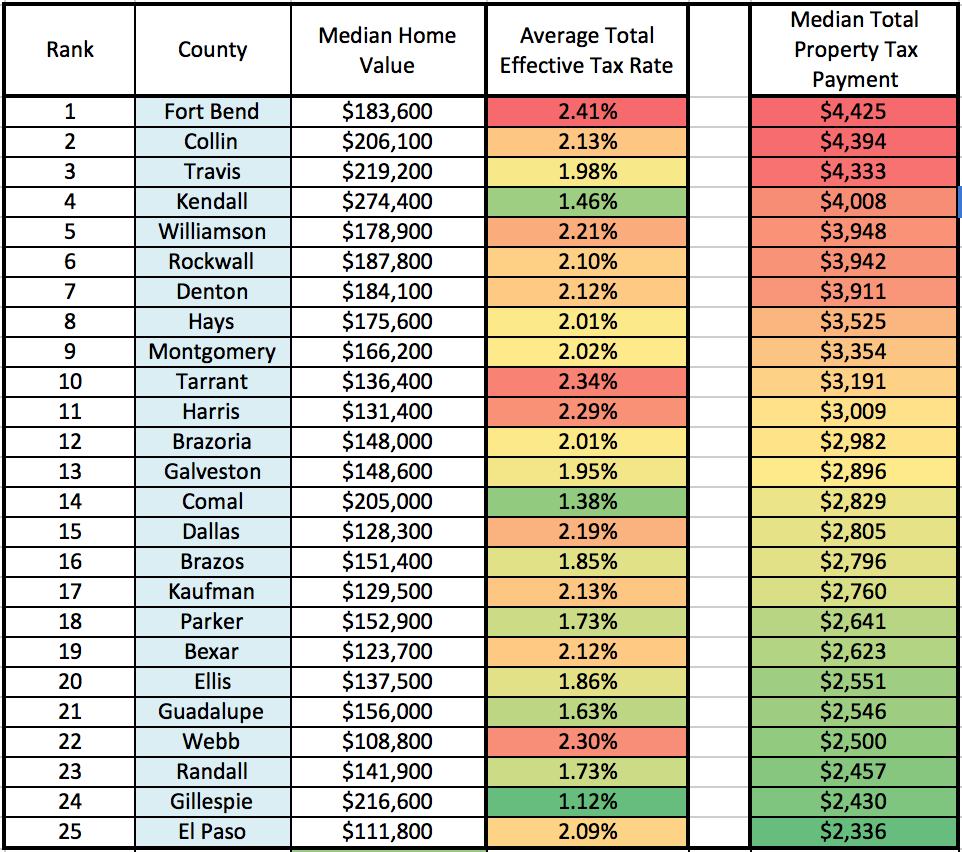

Where Do Texans Pay The Highest Property Taxes

U S Cities With The Highest Property Taxes

San Antonio Property Tax Rates H David Ballinger

Property Tax Information Bexar County Tx Official Website

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Can Texas Fix Its Broken Property Tax System These Lawmakers Ideas Might Not Have A Chance

If You Think Your Property Tax Bill Will Drop This Year Think Again Here S How You Can Fight An Increase

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Tax Breaks For Developers Under Scrutiny In San Antonio Texas Capitol San Antonio Heron

Largest Budget In San Antonio History Gives Smaller Percentage Of Funding To Police Fire Departments The Texan

Are You Paying Too Much In Texas Property Taxes Tax Advisors Group